|

|

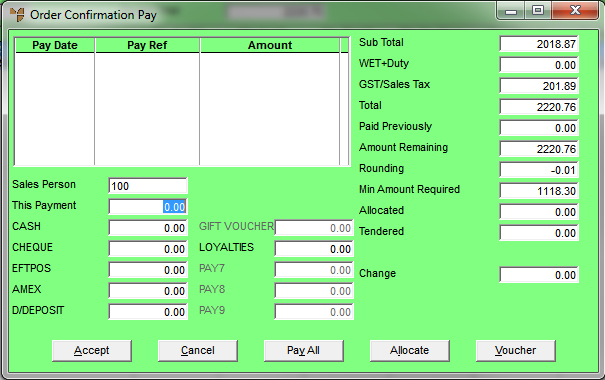

Sales Person

|

Micronet displays the salesperson entered when the order was created. You can change this if required by entering your own salesperson ID, or by deleting the salesperson displayed and pressing Enter to select from a list.

|

|

|

This Payment

|

Enter the amount the customer is paying now.

|

|

|

[Payment Methods]

|

If you want to pay the amount received from the customer against a single payment type, Tab to the field for the required payment type then select the Pay All button.

Otherwise, enter the amount received from the customer against the appropriate payment type. You can dissect the amount across several payment types if required, e.g. if the customer pays partly by cash and partly by credit card. Options may include:

- CASH – enter the full amount or enter more than the full amount for change to be given

- CHEQUE – enter the amount to be paid by cheque. Micronet displays the Enter Banking Details screen where you should enter the cheque details then choose the OK button.

- EFTPOS – for EFTPOS and card payments:

- If the customer is paying by EFTPOS or credit card using Tyro, enter the payment amount as an EFTPOS payment type.

- If the customer wants cash out, increase the amount entered in the EFTPOS payment type field by the amount of cash out required. The cash out is indicated by the value in the Change field.

- If you just want to generate a cash out, create a zero dollar invoice with a payment amount.

- AMEX – see the instructions for EFTPOS

- DIRECT DEPOSIT

- GIFT VOUCHER – see "Order Confirmation Pay - Voucher"

- REBATE – this payment type is only displayed if your customer has rebates activated. You can enter the amount to be redeemed as all or part of the payment. You may need to check the Available Rebates first by performing a debtor rebate inquiry – see "Sales Desk Inquiries - Debtor".

The payment types displayed are setup in your company configuration – see "Edit Company - Edit - Payment Types".

|

|

|

Sub Total

|

Micronet displays the subtotal of all lines on the order, excluding additional amounts such as freight, levies, surcharges and GST.

|

|

|

WET+Duty

|

Micronet displays any Wine Equalisation Tax that applies to items on the order (liquor industry items only), plus any duty or excise that applies to the order.

|

|

|

GST/Sales Tax

|

Micronet displays the amount of GST or sales tax applicable on the order.

|

|

|

Total

|

Micronet displays the order total, taking into account all additional amounts entered on this screen.

|

|

|

Paid Previously

|

Micronet displays the total amount of payments already paid against this order.

|

|

|

Amount Remaining

|

Micronet displays the current amount owing on the order.

|

|

|

Rounding

|

Micronet displays any rounding amount on the order total, e.g. if payments are rounded to the nearest 5 cents or 10 cents.

Rounding is set in the Rounding on Payments field on the Invoicing Configuration screen – see "Edit - Program - Invoicing".

|

|

|

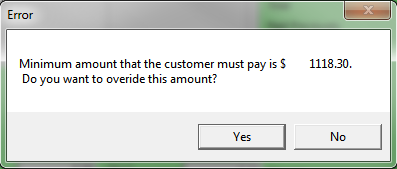

Min Amount Required

|

Micronet displays the minimum amount the customer must pay.

|

|

|

Allocated

|

Micronet displays any amounts allocated to finance companies – see "Order Confirmation Pay - Allocate".

|

|

|

Tendered

|

Micronet displays the total amount of the current payment entered against all payment types.

When you have finished entering payment amounts, the amount in this field should equal the amount in the This Payment field.

|

|

|

Change

|

If the customer is paying by cash, Micronet displays any change owed.

|